The Retirement Readiness Quiz

Let’s take a look at what you’ve done to prepare for your retirement. There are no wrong answers, it’s just an assessment to see where you land on the path to retirement.

*Used by permission from the Forbes release of

The All-Weather Retirement Portfolio

by CEO Randy L. Thurman, CFP®.

Do you know how much you will receive in Social Security benefits?

Social Security benefits are an important consideration in retirement.

Have you decided when to take Social Security benefits?

Do you have a spending plan for retirement including health expenses?

Health expenses can be drastically higher in retirement. You will want to have a good plan in place.

When did you last review your life and health insurance?

Have you determined how you will provide for long-term healthcare?

When did you last update or review your will?

Keeping your estate plan up to date is incredibly important for you and for your heirs.

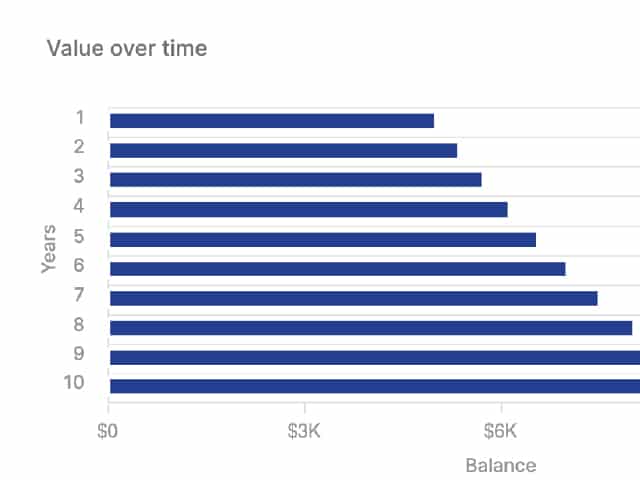

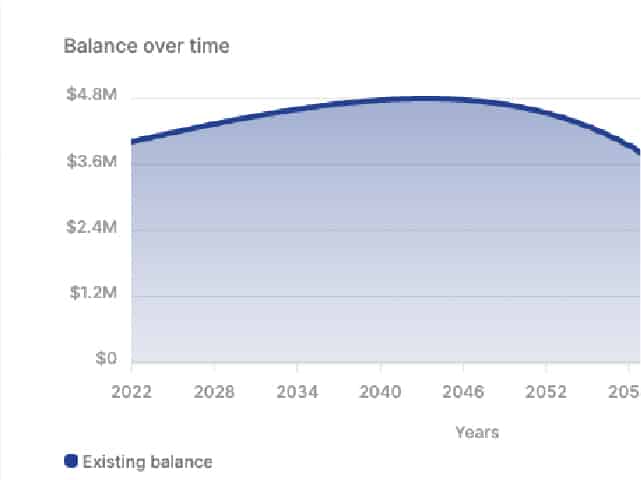

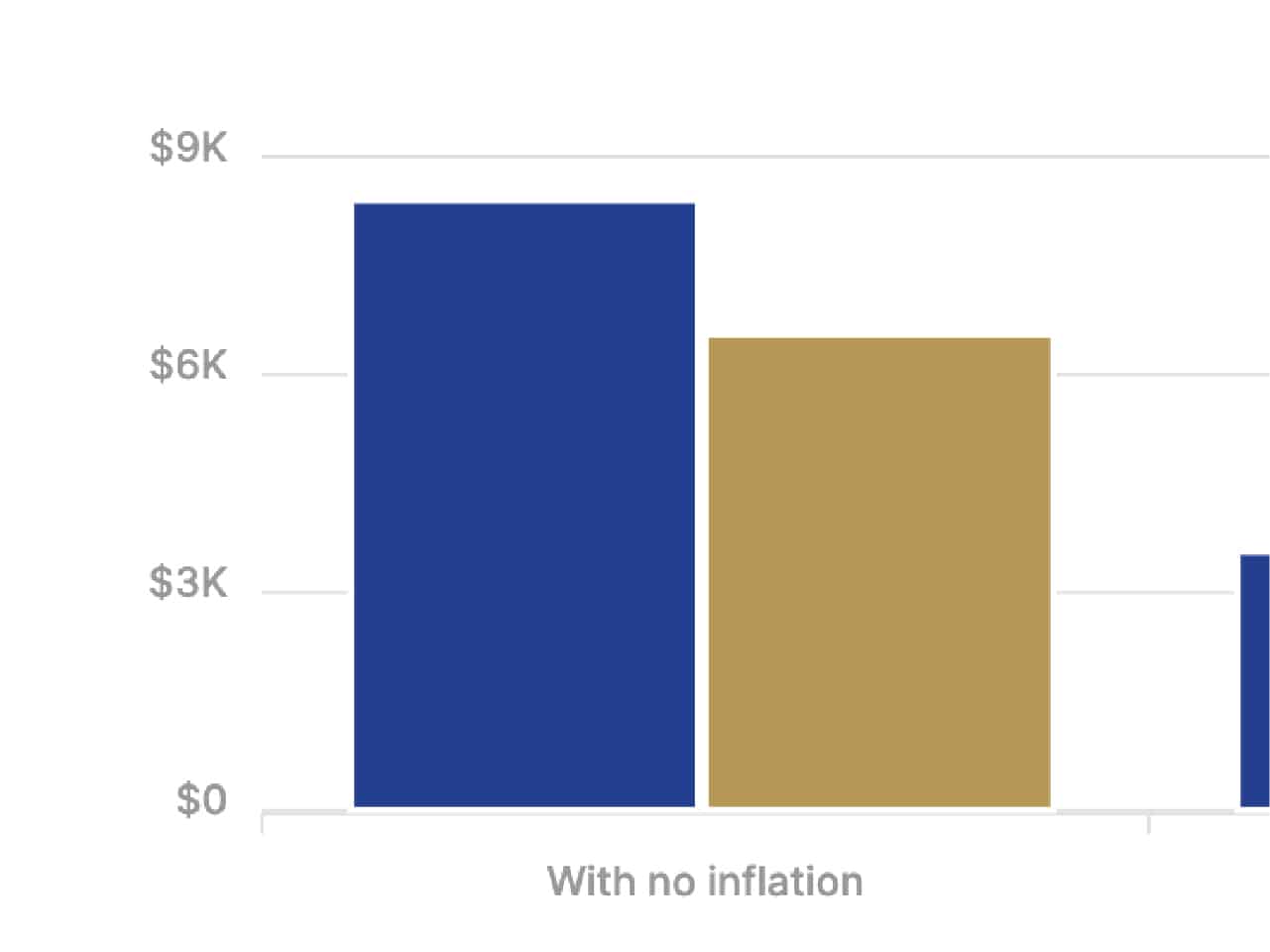

Have you calculated how much income you need for a comfortable retirement?

Determining your retirement income is critical to making sure your money lasts.

How recently did you determine your net worth?

How diversified are your assets?

Check all that apply.What will you do with your company pension plan?

Which professionals have you consulted with regarding retirement?

Having a knowledgable team of professionals guiding you is a key to your success.

If you’re married, is your spouse retired or planning to retire?

Planning ahead for what life will look like in retirement is important to your happiness level in retirement.